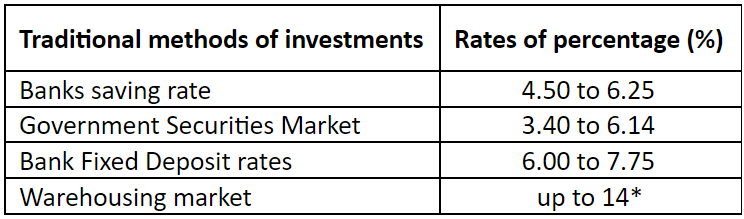

Agri warehousing is a low margin and high volume seasonal business which needs sufficient networking among buyers and sellers. If you look at the different rates of interest offered by the traditional methods of investing in the below-mentioned table.

The potential yearly earnings in the agri warehousing space can be up to 14%*, much more than traditional investing methods. Despite the economic slowdown and the pandemic, the warehousing market has remained largely strong. Demand has been driven in the form of growing GDP, implementation of GST, growing international trade, maturing industry segments, and organized retail participation. Such demand has been robust in industries such as agriculture, e-commerce, FMCG, and 3 PL (third-party logistics) and it has been projected to continue in the current financial year.

There is a growing demand for warehouses especially with the recent export surge in FY 20-21 which helped boost activities in the agri value chain participants, but there has been insufficient supply. The ongoing pandemic has led to a disruption in the supply chain across sectors in the country, resulting in an increasing demand for storage space from commodities, electronics, and the FMCG sector. India’s major warehousing hubs are set to see a rise in rentals as severe disruptions in supply chains due to the pandemic forces companies to keep inventory close to major consuming centers in hopes of a steady recovery in demand.

The warehousing industry has undergone formalization which has attracted the interest of several investors, as they have shown keen interest in investing in the warehousing and logistics business. A recent example being Blackstone group invested in Allcargo Logistics and Singapore-based Mapletree Investments Pte Ltd purchasing a 7 lakh sq ft of an industrial warehouse near Pune from KSH Infra. This shows that there is a potential investment opportunity as seen when major players have been entering the warehousing space. According to the 2020 Knight Frank report on warehousing, institutional investors had been investing substantially over the years. In 2019 they had invested $1.8 billion and the investor activity which was subdued in 2020 due to Covid-19 disruptions has seen a steady rise in 2021.

Warehousing companies like StarAgri, being one of Asia’s leading postharvest solutions companies in the market, has been driving a systemic change in India’s agribusiness sector. There is a need to spur innovative partnerships for distribution solutions to extend the last-mile reach economically and capture the enormous business opportunities presented by the rural consumer and financial outreach. They have an unrivaled rural penetration and farmer linkages to reach the untapped geographies of India. They are well-positioned to ride on the rural opportunity while serving the larger cause of financial inclusion. With investment opportunities in the warehousing segment available, the warehousing sector is here to stay.

*Disclaimer: Data and statistics are for representational purposes; they are based on past performance and will be subject to market risks.

To learn more about the warehouse market, how you can become a warehouse partner with Staragri, and start earning a lucrative income, please register below.

Connect With Us

Connect With Us