Sowing period: June to July

Harvesting period: October to November

Crop season: Kharif

Key growing regions:

- Madhya Pradesh – Sehore, Raisen, Bhopal, Vidisha, Sagar, Guna, Harda, Hoshangabad, Betul

- Maharashtra – Buldhana, Latur, Amravati, Yavatmal, Washim, Nanded, Akola, Hingoli

- Rajasthan – Kota, Bundi, Baran, Pratapgarh, Jhalawar, Banswara, Chittorgarh, Tonk

- Karnataka – Belgaum, Bidar, Dharwad, Haveri

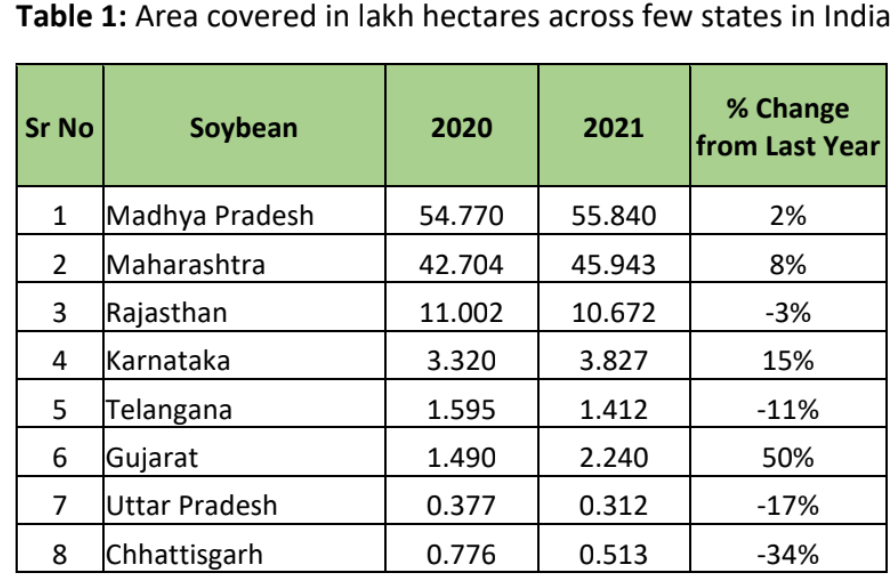

Production trend and Stock position:

- As per the Ministry of Agriculture fourth advance estimate released on August 11, 2021, Soybean production for FY 2020-21 was 128.97 lakh metric tonne (LMT) compared to FY 2019- 20 which was 112.26 LMT, up by 14.89 percent

- As per recent United States Department of Agriculture (USDA) August 2021 report, Soybean production in the world is likely to increase to 383.63 MMT in next season in expectation of higher crop size in US and India

- According to The Soybean Processors Association of India (SOPA) Soybean crop condition seems to be in good condition

- Government has reduced import duty on edible oils with immediate effect, the base import duty on crude palm oil has been reduced to 2.5 from 10 percent, while the tax on crude soya oil and crude sunflower oil has been reduced to 2.5 from 7.5 percent

- According to Ministry of Agriculture, the sowing acreage of Soybean as on August 20, 2021 was 121.59 lakh hectares (lh) up by 0.81 percent compared to 120.61 lh during the corresponding period

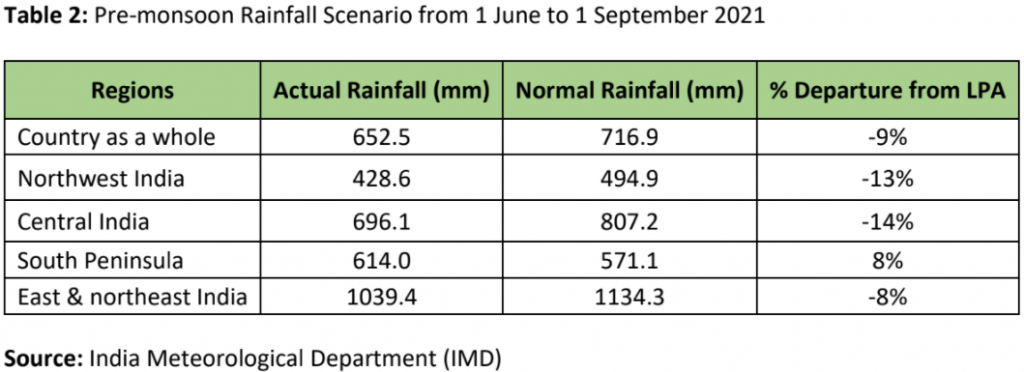

Monsoon Update

For the country as a whole, cumulative rainfall during this year’s monsoon season till September 1, 2021 is below Long Period Average (LPA) by 9 percent. Details of the rainfall distribution over the four broad geographical regions of India are given below:

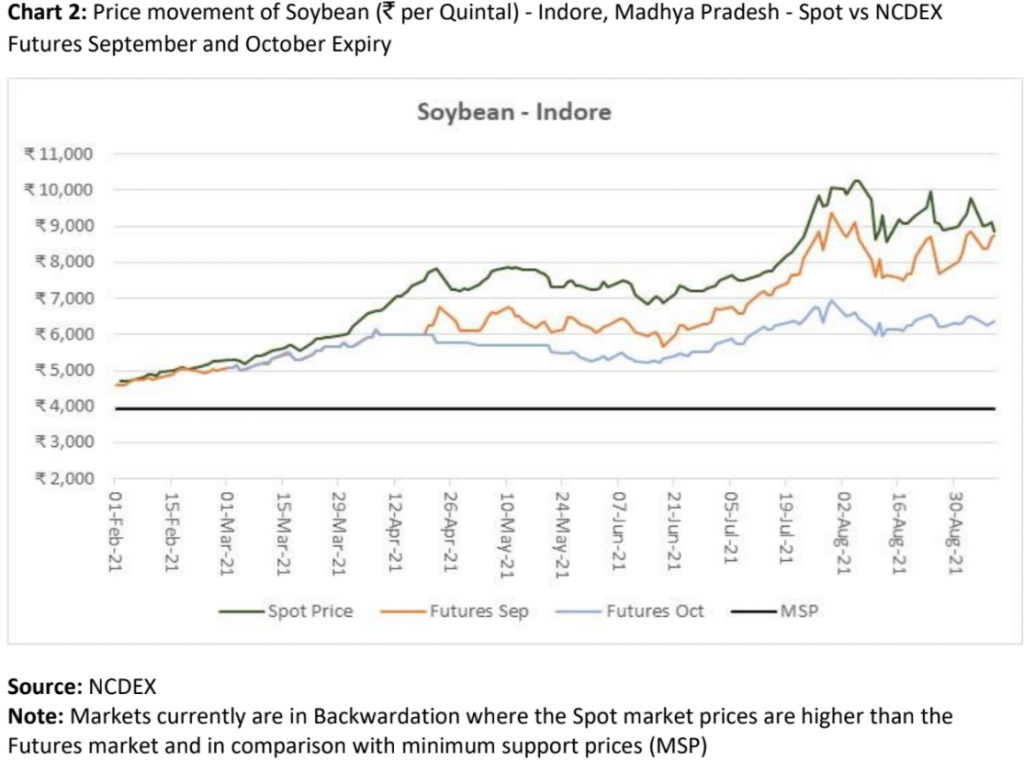

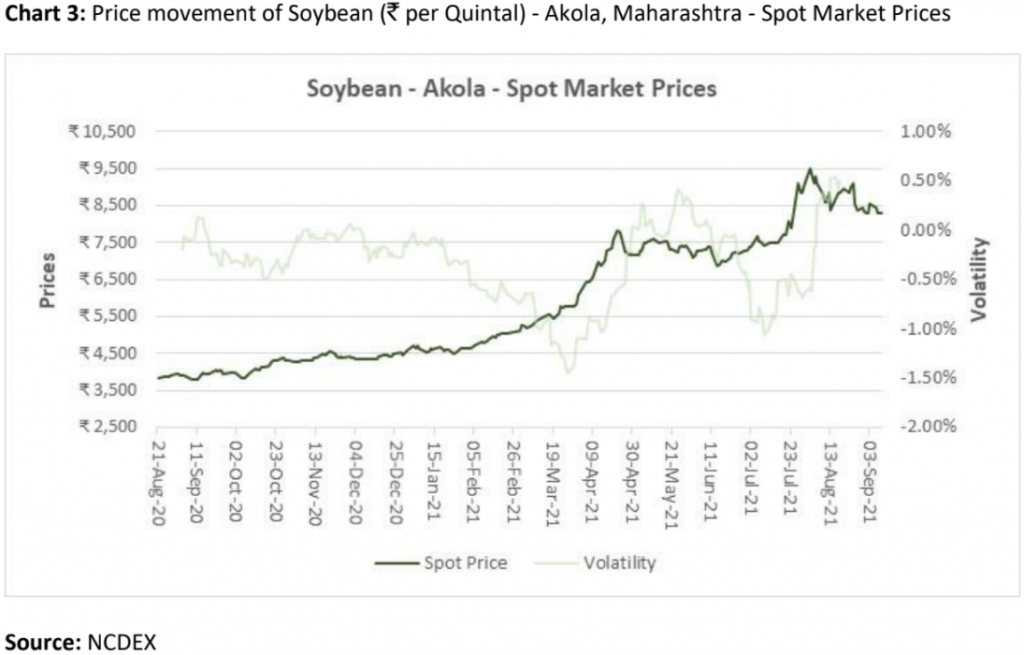

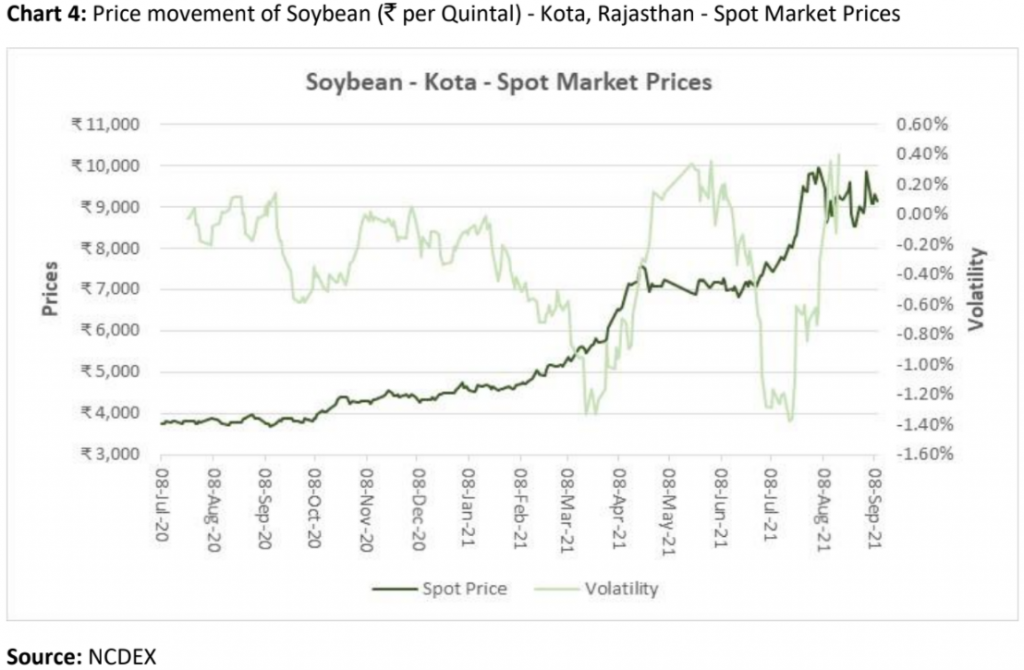

Market commentary: Price outlook

- The Government had increased the Minimum Support Price (MSP) of Soybean by 1.80 percent ₹ 3,950 per quintal for marketing year (MY) 2021-22 compared to2020-21 ₹ 3,880 in 2020-21

- Soybean prices are likely to higher with firm bias in immediate /short term due amid inventory shortage and bullish sentiments in international soybean markets which would lend some support

- NCDEX September futures have been bullish whereas October futures have been bearish in comparison, as arrivals would start in the month of October

Connect With Us

Connect With Us